Almost anything that you wish to purchase you can purchase at a lower price per unit if you buy in greater volume. Occasionally this will even kick in as soon as a second item, with “Buy Two Get One Free” offers. Are economies of scale an iron-clad law of the market?

Not, alas when it comes to survey research. For target audiences are often of a limited size, and convincing that next member of an audience to take a survey often requires a greater expense.

We once surveyed a house list (our client’s private email list) across 11 segments, with quota cells of 50 to 100 per segment. Many cells filled up after the invitation email and two follow-up reminders. But some quota cells were nearly empty. We ended up doing a targeted mailing offering $25 Amazon gift cards, which closed some of the quota cells. But even that wasn’t enough to finish all the segments before we had to begin analysis.

For another house list survey, after an invitation and reminder produced little response, we offered $10 gift cards. Then $20 gift cards. Then $50 gift cards.

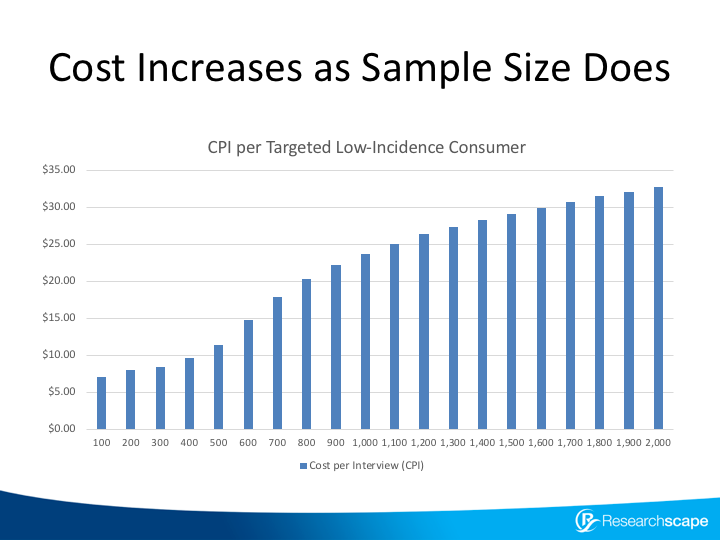

As a final example, we often survey low-incidence groups of consumers, such as people who use a product with low market share or who suffer a rare chronic ailment. For one project, we received quotes from 11 different panel providers: prices ranged from $6 to $95 per respondent, and – due to different sized panels – providers reported that they could provide between 20 and 3,100 respondents each. As a result, we could provide 100 responses at a cost of $7.08, 200 for $8.04, 300 for $8.36, or 2,000 for $32.69 apiece.

B2B surveys published in a news release have a median of 500 responses, and B2Cs survey have a median of 1,200 – but for some audiences, due to diseconomies of scale, these sample sizes are just not feasible.

Originally published September 28, 2018; links and graphics updated.